Equitable dental insurance eligibility verification is crucial for ensuring fair and consistent access to dental care. This guide provides a comprehensive overview of the process, from defining eligibility criteria to addressing variations and exceptions, and incorporating technology and legal considerations. Understanding these elements is vital for both dental providers and patients.

This guide delves into the specifics of equitable dental insurance eligibility verification, explaining the key principles and procedures for accurate and efficient verification. It also highlights the importance of maintaining transparency and accuracy throughout the process.

Defining Equitable Dental Insurance Eligibility

Equitable dental insurance eligibility hinges on a principle of fairness, ensuring all individuals have a reasonable chance of obtaining coverage based on demonstrably objective criteria. This necessitates a thorough understanding of the various facets of eligibility, from coverage stipulations to pre-existing condition considerations. The application of equitable principles should be consistent across different dental insurance plans, fostering trust and transparency in the system.Eligibility assessments must not discriminate against individuals based on factors unrelated to their health status or risk profile.

The concept of equitable eligibility extends to the meticulous verification process, aiming to prevent fraud and ensure accurate representation of claims. This approach promotes the integrity of the dental insurance industry as a whole.

Coverage Criteria

Dental insurance plans vary considerably in the types of procedures and services they cover. Equitable eligibility requires a clear definition of these covered services, presented in a transparent and easily accessible format. This includes specifics on preventative care, restorative treatments, and specialized procedures. Clear communication about exclusions and limitations is crucial to ensure potential beneficiaries understand the scope of coverage.

Pre-existing Conditions

The handling of pre-existing conditions is a significant aspect of equitable eligibility. Ideally, plans should not exclude individuals with pre-existing conditions from coverage altogether. Instead, they should clearly Artikel how these conditions are addressed within the plan. This might involve a waiting period before coverage commences for certain procedures related to the pre-existing condition. Equitable plans should not impose unreasonably long waiting periods, and any waiting period should be clearly communicated.

Waiting Periods

Waiting periods for certain procedures or services can be a critical factor in determining eligibility. Equitable plans must clearly define and justify any waiting periods. These periods should be proportionate to the nature of the procedure and the potential risk associated with the service. The rationale behind the waiting period should be transparent and consistently applied. Waiting periods for routine check-ups and preventive care should be minimized or non-existent to encourage preventative measures.

Types of Dental Insurance Plans

Equitable eligibility principles apply to all types of dental insurance plans. These include indemnity plans, managed care plans, and high-deductible plans. Each plan type will have unique eligibility criteria. However, the fundamental principles of fairness and transparency must be maintained. The emphasis should always be on ensuring that the criteria for eligibility are clear, consistent, and readily accessible to potential beneficiaries.

Significance of Equitable Eligibility Verification

Accurate and fair eligibility verification is paramount to the integrity of the dental insurance system. It ensures that claims are processed correctly and efficiently, and that premiums are appropriately allocated. Inequitable eligibility verification can lead to fraud, misallocation of funds, and ultimately, undermine the entire system’s effectiveness.

Table of Common Factors in Equitable Dental Insurance Eligibility

| Factor | Description | Example | Impact on Eligibility |

|---|---|---|---|

| Coverage Criteria | Specific services covered (e.g., fillings, cleanings, crowns). | Coverage for routine cleanings, but not cosmetic bonding. | Applicant is eligible for cleanings, but not cosmetic bonding. |

| Pre-existing Conditions | How pre-existing conditions are handled (e.g., waiting periods). | A waiting period of six months for root canal treatment related to a previous cavity. | Applicant may be eligible after the waiting period. |

| Waiting Periods | Time before coverage begins for specific procedures. | A 3-month waiting period for orthodontic treatment. | Applicant may not be eligible for braces until after 3 months. |

| Plan Type | Different criteria for various insurance plans. | Indemnity plans often have more flexibility in choosing providers. | Flexibility in provider selection impacts eligibility process. |

Addressing Variations and Exceptions

The equitable verification of dental insurance eligibility necessitates a nuanced approach that accounts for potential discrepancies across geographic regions and diverse plan designs. Standard criteria, while crucial for efficiency, must be adaptable to accommodate exceptions and special circumstances. This flexibility ensures a fair and consistent process for all individuals, regardless of their specific location or plan type.

Geographic Variations in Eligibility Criteria

Geographical location often influences the specifics of dental insurance plans. Regional variations in healthcare costs and provider networks can impact eligibility criteria. For instance, a plan might have more restrictive coverage for services in a high-cost metropolitan area compared to a rural region with fewer providers. Understanding these differences is vital for accurate eligibility verification. This requires a comprehensive database that stores and updates regional plan details.

Handling Exceptions to Standard Requirements, Equitable dental insurance eligibility verification

Exceptions to standard eligibility requirements are inevitable. Circumstances such as pre-existing conditions, military service, or participation in special programs may necessitate adjustments to the verification process. A well-structured system for handling exceptions is essential to avoid potential misclassifications and ensure equitable access to care. An effective approach involves a defined protocol for handling exceptions, clear documentation of the adjustments, and a dedicated review process to address any ambiguities.

Special Cases and Situations Requiring Adjustments

Special cases requiring adjustments to the verification process include situations like those involving dependents of military personnel, those receiving coverage under specific government programs, or those with complex medical histories. The verification process must adapt to accommodate these situations to ensure that individuals are not unfairly denied coverage due to bureaucratic hurdles. Carefully documenting the specific circumstances and the rationale behind any adjustments is crucial for maintaining an audit trail and ensuring transparency.

Documentation of Exceptions for Audit Trails

Thorough documentation of exceptions is essential for audit trails and transparency. This includes detailed records of the reason for the exception, supporting documentation (e.g., military orders, government program enrollment information), and the specific adjustments made to the verification process. Such documentation helps to ensure that the eligibility verification process is consistently applied and that any deviations from standard procedures are justified.

Clear, concise documentation also facilitates internal audits and external regulatory reviews.

Table of Common Variations and Handling Procedures

| Variation | Handling Procedure | Example | Impact on Verification |

|---|---|---|---|

| Geographic differences in coverage limits | Consult regional plan databases to determine specific coverage parameters. | A plan covering $1000 in preventative care in one state, but $500 in another. | Verification must retrieve and apply the correct geographic limit. |

| Dependent coverage under specific circumstances (e.g., military dependents) | Utilize specialized forms and verification processes. | A dependent of a military member. | Requires verifying military affiliation and appropriate eligibility codes. |

| Pre-existing conditions requiring special waivers | Follow documented waiver procedures and obtain necessary approvals. | A patient with a pre-existing condition that requires a waiver for coverage. | Verification needs to identify and apply waiver protocols, potentially involving secondary approvals. |

| Coverage under government programs | Verify eligibility through specific government portals or databases. | Medicare, Medicaid, CHIP. | Requires direct interaction with the relevant government agency database. |

Technology and Automation

The relentless march of technological advancement presents a potent opportunity to refine the dental insurance eligibility verification process. Modern tools offer a path towards enhanced efficiency, accuracy, and transparency, mitigating the inherent complexities of handling diverse insurance plans and individual patient needs. The application of automation in this domain is not merely a trend, but a crucial evolution toward a more equitable and streamlined system.The integration of technology promises a paradigm shift in the handling of eligibility verification.

Yo, tryna get my dental insurance straightened out, you know? Like, figuring out if I’m even eligible for that sweet, sweet coverage. Gotta check my benefits, and then maybe hit up Schoenbauer Funeral Home in Montgomery, MN for some info on the whole insurance thing. It’s all about that dental insurance eligibility verification, you feel me?

Gotta get my pearly whites looking fresh for the new school year.

By automating routine tasks, practitioners can dedicate more time and attention to patient care, thereby fostering a more personalized and patient-centric approach to dental services. This shift in focus, in turn, contributes to a more equitable distribution of resources and improved access to care.

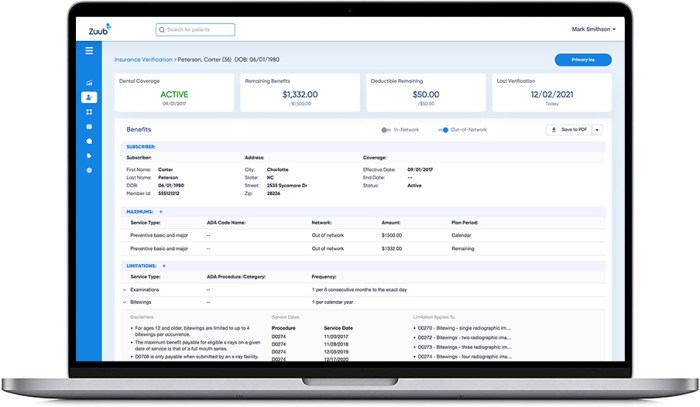

Streamlining the Verification Process

Automation, when effectively implemented, simplifies the intricate process of insurance eligibility verification. Software applications can automatically extract relevant data from insurance provider databases, reducing the manual effort and associated errors. This automated extraction, combined with robust data validation, ensures a more accurate and timely determination of eligibility.

Improving Efficiency and Accuracy

The application of automation yields significant improvements in efficiency. Tasks that previously consumed substantial time, such as data entry and manual retrieval, are now handled swiftly and precisely by automated systems. This efficiency translates directly into reduced processing times and, consequently, a faster response for patients. Furthermore, the inherent precision of automated systems minimizes errors, enhancing the accuracy of the eligibility determination.

This accuracy fosters greater trust and confidence in the verification process, particularly for patients with complex or multiple insurance plans.

Technological Tools and Systems

A diverse range of technological tools and systems are currently employed in eligibility verification. Electronic Health Records (EHR) systems often incorporate modules for insurance data integration and automated verification. Specialized third-party applications facilitate seamless communication with insurance providers’ databases, allowing for real-time data retrieval and validation. Cloud-based platforms further enhance accessibility and scalability, ensuring data is readily available to authorized personnel across various locations.

Yo, tryna figure out if my dental insurance is gonna cover me? Legit, checking eligibility is kinda a pain, but like, if you’re looking for a tasty meal to distract you while you’re doing that, you should totally check out this hello fresh onion crunch chicken recipe. It’s totally bomb, and trust me, it’ll keep your mind off the whole insurance verification process.

Still, gotta get that dental insurance sorted though, you know?

Ensuring Secure Data Handling

Data security is paramount in the context of eligibility verification. Robust encryption protocols are crucial for safeguarding sensitive patient information. Secure authentication mechanisms, such as multi-factor authentication, are essential to prevent unauthorized access. Compliance with relevant privacy regulations, like HIPAA, is non-negotiable and must be meticulously integrated into the technological framework. Regular security audits and updates further fortify the system against evolving threats.

Enhancing Transparency

Transparency in the eligibility verification process is paramount. Automated systems can provide clear and concise reports, detailing the steps taken and the rationale behind the eligibility determination. This transparency fosters trust and understanding between the dental practice and the patient. Patients can readily access their eligibility status through secure online portals, facilitating a more informed and proactive approach to their dental care.

This, in turn, empowers patients to manage their health and finances more effectively.

Legal and Regulatory Considerations

Navigating the complex landscape of dental insurance eligibility verification necessitates a profound understanding of legal and regulatory frameworks. These frameworks, designed to protect consumers and ensure fair practices, establish essential boundaries and guidelines for verifying eligibility. Failure to comply with these regulations can lead to substantial legal repercussions. This section delves into the critical legal and regulatory aspects of dental insurance eligibility verification.

Legal Requirements for Eligibility Verification

Dental insurance eligibility verification processes are not arbitrary; they are governed by specific legal requirements. These requirements dictate the manner in which insurance companies and providers must handle claims and requests for verification. Compliance with these regulations is paramount for maintaining a fair and equitable system.

Importance of Regulatory Compliance

Compliance with relevant regulations is crucial for upholding the integrity of the dental insurance system. Adherence to these rules ensures that consumers receive the benefits they are entitled to and that providers operate within the bounds of ethical and legal practice. This, in turn, fosters public trust and confidence in the system.

Consequences of Non-Compliance

Non-compliance with legal and regulatory requirements for dental insurance eligibility verification can have severe consequences. These consequences can range from fines and penalties imposed by regulatory bodies to legal actions initiated by consumers or government agencies. Examples include lawsuits alleging breach of contract or unfair business practices.

Ensuring Adherence to Legal and Regulatory Frameworks

Ensuring adherence to legal and regulatory frameworks requires a multi-faceted approach. This includes establishing clear internal policies and procedures for eligibility verification, training staff on the relevant regulations, and implementing robust systems for monitoring and auditing compliance. Regular review and updates to these policies in response to evolving regulations are essential. Additionally, maintaining detailed records of all eligibility verification processes is vital for accountability and future reference.

Summary of Key Legal and Regulatory Guidelines

Key legal and regulatory guidelines for eligibility verification often address data privacy, consumer rights, and the documentation of verification procedures. They typically require accurate and complete documentation, timely responses to requests, and a process for handling disputes. The specific requirements vary depending on jurisdiction and may include detailed specifications regarding the format and content of verification records, the timeframe for responses, and the procedures for handling appeals.

Furthermore, maintaining accurate records of all communications and decisions related to eligibility verification is crucial for compliance and potential disputes. For instance, regulations might mandate specific documentation standards for appeals processes.

Ending Remarks

In conclusion, equitable dental insurance eligibility verification is a multifaceted process that requires careful consideration of various factors, including coverage criteria, pre-existing conditions, and geographic variations. By adhering to the guidelines Artikeld in this guide, stakeholders can ensure a fair and transparent process, ultimately supporting patient access to necessary dental care.

Answers to Common Questions: Equitable Dental Insurance Eligibility Verification

What are the common factors considered in determining eligibility?

Factors considered include plan type, coverage limits, waiting periods, and pre-existing conditions. Refer to the provided table for specific examples.

How can I handle variations in eligibility criteria?

Variations based on location or plan design should be documented. Consult the handling procedures table for examples of how to manage these situations.

What technology can be used to streamline the process?

Online portals, automated systems, and secure data handling tools can significantly improve efficiency and accuracy. The guide includes examples and best practices for implementation.

What are the legal requirements for eligibility verification?

Adherence to relevant regulations is essential. The guide Artikels key legal and regulatory guidelines to ensure compliance.