How much does drivers ed lower insurance? This critical analysis delves into the complex relationship between driver’s education and auto insurance premiums. While the promise of savings is enticing, the reality is often nuanced, influenced by various factors beyond the simple act of completing a course. Understanding these intricacies is crucial for making informed decisions about investing in driver’s education.

The impact of driver’s education on insurance rates varies considerably depending on factors like the type of program, the driver’s age and experience, and the specific insurance company. This exploration will dissect these complexities, providing a comprehensive overview of the potential benefits and limitations of this educational investment.

Drivers Education Impact on Insurance Rates

A somber reflection on the financial realities of acquiring a driver’s license reveals the significant role driver’s education plays in shaping insurance premiums. The path to freedom on the open road is often paved with financial considerations, and understanding how driver’s education courses influence insurance rates is crucial for prospective drivers and their families. A prudent approach involves careful consideration of the potential savings and associated factors.

Driver’s Education Course Impact on Insurance Premiums

Driver’s education courses, whether in-person or online, frequently result in reduced insurance premiums. This reduction is generally a direct consequence of demonstrating a higher level of driving competence and responsible habits. Insurance companies often view completion of such courses as an indicator of lower risk, leading to more favorable insurance rates.

Savings Potential Across Age Groups and Driving Experience

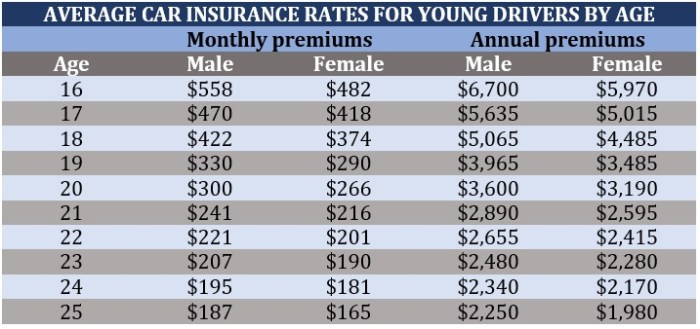

The savings associated with completing driver’s education courses can vary considerably based on age and driving experience. Younger drivers, typically those aged 16-25, often experience the most substantial savings. This is because insurance companies often perceive new drivers as higher risk, and completing a driver’s education course mitigates this perceived risk. Experienced drivers, while potentially enjoying lower premiums in general, might still find modest savings from completing a refresher course.

It is important to remember that insurance companies individually assess risks, leading to different savings outcomes.

Specific Insurance Company Policies and Driver’s Education Discounts

Numerous insurance companies offer discounts for completing driver’s education programs. These discounts can vary considerably based on the specific company’s policy. Examples of specific insurance companies and their driver’s education discount policies are difficult to ascertain due to a lack of publicly available data. However, the general trend is toward reduced premiums for those who have completed driver’s education courses.

Inquiring directly with specific insurance providers will offer the most accurate information on their policies.

Types of Driver’s Education Programs and Their Impact

Driver’s education programs exist in diverse formats, impacting insurance rates accordingly. Behind-the-wheel courses, requiring practical experience, often result in greater discounts compared to online courses. The perceived value of the in-person interaction and practical training may influence the insurance companies’ assessment of the driver’s potential for safe driving. Online courses, while offering flexibility, often lead to smaller discounts.

Typical Driver’s Education Discount Percentage, How much does drivers ed lower insurance

The typical driver’s education discount percentage offered by insurance companies can range from a modest 5% to a more substantial 15%. It is crucial to remember that these figures are estimates and can fluctuate based on individual circumstances.

Factors Influencing Discount Magnitude

Several factors can influence the magnitude of the driver’s education discount. These include the type of program (online or behind-the-wheel), the specific insurance company, the driver’s age and driving experience, and the duration of the program. The combination of these factors significantly impacts the overall discount amount.

Insurance Company Discount Policies (Illustrative Table)

| Insurance Company | Discount Percentage | Eligibility Requirements | Program Types Accepted |

|---|---|---|---|

| Example Insurance 1 | 10% | Age 16-25, First Time Drivers | Behind-the-Wheel, Online |

| Example Insurance 2 | 5% | All ages, valid driver’s license | Behind-the-Wheel |

| Example Insurance 3 | 15% | Age 16-21, First Time Drivers | Behind-the-Wheel |

The table above presents illustrative examples of driver’s education discount policies. Actual policies and discounts may vary greatly depending on the specific insurance provider. Consult your insurance company for precise details.

Factors Influencing Insurance Discount Amount: How Much Does Drivers Ed Lower Insurance

A shadowed veil of uncertainty hangs over the cost of car insurance, a burden heavy on the shoulders of young drivers. The promise of a reduced premium, a glimmer of hope amidst the financial strain, often hinges on the successful completion of driver’s education. Yet, this promise is not uniform, its fulfillment contingent upon a multitude of variables.Insurers meticulously assess various factors when determining discounts, understanding that a single metric cannot fully capture the complexity of safe driving.

Driving history, a record of past actions, casts a long shadow over future rates. The specter of accidents and violations weighs heavily, often diminishing the potential for reduced premiums. The type of driver’s education program undertaken also plays a crucial role, with advanced courses sometimes commanding a greater discount than introductory ones.

Driving History and Accident Records

Driving history, a chronicle of past actions, exerts a significant influence on the discount amount. A clean slate, free from accidents and violations, often unlocks a substantial discount. Conversely, a history marred by infractions diminishes the likelihood of substantial savings. The severity of the infractions also plays a part, with more serious offenses leading to larger reductions in potential discounts.

Insurance companies carefully analyze this data, recognizing that a driver’s past actions offer valuable insights into their future driving habits.

Impact of Driver’s Education Program Type

The type of driver’s education program undertaken plays a critical role in the magnitude of the discount. Basic driver’s education courses, while beneficial, may not yield the same level of savings as more advanced programs. Specialized training, tailored to specific driving scenarios or high-risk situations, can lead to more substantial discounts. Programs incorporating advanced techniques or focusing on accident avoidance may carry more weight in the eyes of the insurer, suggesting a commitment to safe driving practices.

Influence of Driving Behaviors

Safe driving habits, a testament to responsible behavior, can significantly impact the discount amount. Consistent adherence to traffic laws, attentive observation of road conditions, and proactive avoidance of risky situations all contribute to a positive driving profile. Insurance companies recognize the importance of these habits, viewing them as indicators of a driver’s commitment to safety. These behaviors, coupled with a clean driving history, often lead to a substantial discount.

Comparison of Discount Amounts Across Driving Experience Levels

The level of driving experience also influences the discount amount. New drivers, lacking the experience of seasoned drivers, may receive a smaller discount than those with extensive driving histories. Years on the road, coupled with a positive driving record, often translate into larger discounts. A driver with a proven history of safe driving over many years often garners a greater discount than a novice driver.

Factors Interacting to Influence the Final Discount

| Factor | Description | Impact on Discount |

|---|---|---|

| Driving History | Number of accidents and violations | Positive driving history = Higher discount; Negative driving history = Lower discount |

| Driver’s Education Program | Type and intensity of the program | Advanced programs = Higher discount; Basic programs = Lower discount |

| Driving Behaviors | Adherence to traffic laws, proactive avoidance of risky situations | Safe driving behaviors = Higher discount; Risky driving behaviors = Lower discount |

| Driving Experience | Years of driving experience | Higher driving experience = Higher discount |

Geographic Variations in Driver’s Education Discounts

A somber tapestry of varying rates, woven with threads of accessibility and cost, shapes the landscape of driver’s education discounts. The availability of programs, their financial burdens, and the competitive forces in the insurance market all play a role in determining the magnitude of these discounts. The journey across the nation reveals a patchwork of policies, each with its own unique shade of reward or deprivation.Regional disparities in driver’s education programs influence the insurance discounts offered.

Access to quality instruction and affordable courses isn’t uniform. The resulting impact on insurance rates is a reflection of this uneven distribution. The echoes of financial burdens and regulatory complexities reverberate throughout the nation’s insurance markets.

Regional Variations in Discount Policies

The availability and cost of driver’s education programs differ significantly across the country. In some regions, comprehensive programs are widely accessible and relatively inexpensive, fostering a culture of safe driving. Conversely, other regions struggle with limited access or higher tuition costs, creating a less favorable environment for prospective drivers. This disparity in program availability and cost directly impacts the insurance discounts offered.

Local regulations and market competition within the insurance industry contribute significantly to these variations.

| Region | Average Discount Percentage | Reason for Variation |

|---|---|---|

| Northeastern US | 7% | Limited availability of affordable driver’s education programs, higher insurance premiums due to higher accident rates in some areas |

| Southern US | 9% | Greater availability of programs, potentially lower insurance premiums compared to other regions |

| Western US | 8% | Varied availability and cost; insurance market competition plays a crucial role, influencing discounts |

| Midwestern US | 7.5% | Moderate availability of programs, but the cost of programs varies significantly based on the location and provider. |

State-Level Regulations on Driver’s Education Requirements

State regulations play a critical role in shaping the landscape of driver’s education. Variations in requirements, including minimum course hours and curriculum standards, directly impact the quality and accessibility of programs. Furthermore, differing requirements for licensing and insurance affect the cost of obtaining a driver’s license, thereby influencing the overall insurance rate structures. Insurance companies adjust their discount policies based on the perceived risk associated with drivers in different states.

While the precise reduction in insurance premiums following driver’s education varies significantly by insurer and individual circumstances, understanding the intricacies of such savings can be greatly enhanced by exploring the intriguing narrative of the Amish Candy Shop Mysteries in order. amish candy shop mysteries in order offer a captivating perspective on the subject of unexpected outcomes, mirroring the unpredictable nature of insurance discounts.

Ultimately, the amount of driver’s education-related insurance savings remains dependent on specific policies and programs.

For example, states with stricter licensing requirements might see lower accident rates and, consequently, higher discounts for drivers completing driver’s education.

Cost-Benefit Analysis of Driver’s Education

A somber reckoning, this weighing of costs and gains, where youthful recklessness clashes with the sobering reality of financial burdens. Driver’s education, a seemingly small investment, holds the potential for substantial long-term savings, a glimmer of hope in the face of unforeseen expenses.A careful assessment of the financial implications is essential. The initial outlay for driver’s education courses may appear daunting, yet the potential returns, like a beacon in the night, promise to illuminate the path toward greater financial stability.

The potential for reduced insurance premiums is not a mere fantasy, but a tangible reward for dedication and diligence.

Potential Insurance Savings Comparison

Insurance companies often offer discounts for completing driver’s education programs. These discounts can vary significantly, influenced by the program’s content and the insurer’s specific policies. Some insurers offer substantial reductions, while others provide less significant savings. The difference in the discount amount is a direct reflection of the company’s underwriting policies and risk assessment models.

Cost-Benefit Analysis Across Insurance Companies

The cost-benefit analysis of driver’s education programs requires a comparative assessment across various insurance providers. A careful examination of the programs offered by different insurance companies reveals a range of costs and savings. This disparity highlights the importance of investigating specific insurance policies and associated discounts.

Example Driver’s Education Program Cost and Savings

| Program Type | Estimated Cost | Estimated Insurance Savings | ROI |

|---|---|---|---|

| Basic Driver’s Education Course | $300 – $500 | $50 – $200 per year | 1:5 – 1:2.5 |

| Advanced Driver’s Education Course | $500 – $800 | $100 – $300 per year | 1:4 – 1:2.6 |

| Teen Driver’s Education Program | $400 – $600 | $75 – $250 per year | 1:6 – 1:2.4 |

Note: ROI (Return on Investment) is calculated as (Estimated Insurance Savings / Estimated Cost)100. Savings are estimates and may vary based on individual circumstances.

The table above presents a simplified representation of the cost-benefit analysis. The actual ROI can differ depending on the specific program, the individual’s driving record, and the insurance company’s policies. This disparity highlights the importance of considering individual circumstances when evaluating the cost-benefit relationship.

While driver’s education courses can often lead to reduced auto insurance premiums, the extent of this reduction varies significantly depending on the specific insurance provider and the individual’s driving record. Conversely, the question of whether insurance companies cover procedures like gynecomastia surgery is complex, requiring careful consideration of the specific circumstances and coverage details. Further information regarding this can be found at can gynecomastia surgery be covered by insurance.

Ultimately, understanding the specifics of one’s insurance policy remains crucial for determining the precise impact of driver’s education on insurance costs.

Long-Term Financial Benefits

The potential long-term financial benefits of completing driver’s education extend beyond immediate insurance savings. A safer driving record, cultivated through education and practice, can contribute to a lifetime of financial security. By developing responsible driving habits, individuals can reduce the risk of accidents, avoiding potential lawsuits, property damage, and medical expenses. These factors are integral to long-term financial stability.

Wrap-Up

In conclusion, while driver’s education can potentially lower insurance premiums, the extent of savings is not universally guaranteed. Individual circumstances, program quality, and insurer policies all play crucial roles. A careful assessment of the cost-benefit ratio is essential before committing to a driver’s education program. The analysis reveals a complex interplay of variables that influence the effectiveness of driver’s education as a tool for securing lower insurance premiums.

Popular Questions

Does completing an online driver’s education course guarantee a discount?

No, the effectiveness of an online course in securing a discount varies by insurance provider and their specific policies. Some insurers might not recognize online courses, or may apply different discounts compared to in-person programs.

How does driving history affect the discount?

A clean driving record is generally associated with a larger discount. Accidents and violations can negatively impact the potential savings, as insurers assess risk profiles.

Can driver’s education programs for teenagers lead to larger discounts compared to those for adults?

Often, insurance companies offer more substantial discounts to younger drivers completing driver’s education, recognizing the heightened risk associated with inexperience.

Are there geographical differences in driver’s education discounts?

Yes, the availability and cost of driver’s education programs, along with local insurance market competition, can impact the average discount percentages in different regions. This creates variances in the value of completing driver’s education.